Paying For College

Finances & EnrollmentThe Challenge of College Tuition

The Impact of Finances on Enrollment

A large number of community college students come from low-income backgrounds, and many others are older and financially independent. As a result, community college students will often enter college with significant financial need. Furthermore, the process of applying for financial aid can be daunting and complex, so students may not be aware that they qualify for grants, scholarships, and other awards. Instead, students may try to rely solely on their own personal income and savings, or the income and savings of family and friends, to finance their education.

Without the assistance of financial aid, paying for tuition, fees, and related expenses is extremely challenging. Students who struggle with how to pay their tuition balances may choose to discontinue enrollment prior to meeting their academic goals. However, there are numerous options available to students, and the NOVA Financial Aid Office can be a vital source of information. Helping students to understand their options and weather financial difficulties will be critical to NOVA’s efforts to help every student succeed.

Nationwide NUMBERS

$120 billion

yearly amount of grants, work-study funds, and low-interest loans awarded to students by the U.S. Department of Education.1

24%

of surveyed students or their parents did not fill out the Free Application for Federal Student Aid (FAFSA).2

34%

of federal Pell grants were awarded to students attending public, two-year institutions.3

77%

of students at four-year institutions received some type of financial aid.4

58%

of students at two-year institutions received some type of financial aid.4

Nationwide NUMBERS

$120 billion

yearly amount of grants, work-study funds, and low-interest loans awarded to students by the U.S. Department of Education.1

24%

of surveyed students or their parents did not fill out the Free Application for Federal Student Aid (FAFSA).2

34%

of federal Pell grants were awarded to students attending public, two-year institutions.3

77%

of students at four-year institutions received some type of financial aid.4

58%

of students at two-year institutions received some type of financial aid.4

Nationwide NUMBERS

$120 billion

yearly amount of grants, work-study funds, and low-interest loans awarded to students by the U.S. Department of Education.1

24%

of surveyed students or their parents did not fill out the Free Application for Federal Student Aid (FAFSA).2

34%

of federal Pell grants were awarded to students attending public, two-year institutions.3

77%

of students at four-year institutions received some type of financial aid.4

58%

of students at two-year institutions received some type of financial aid.4

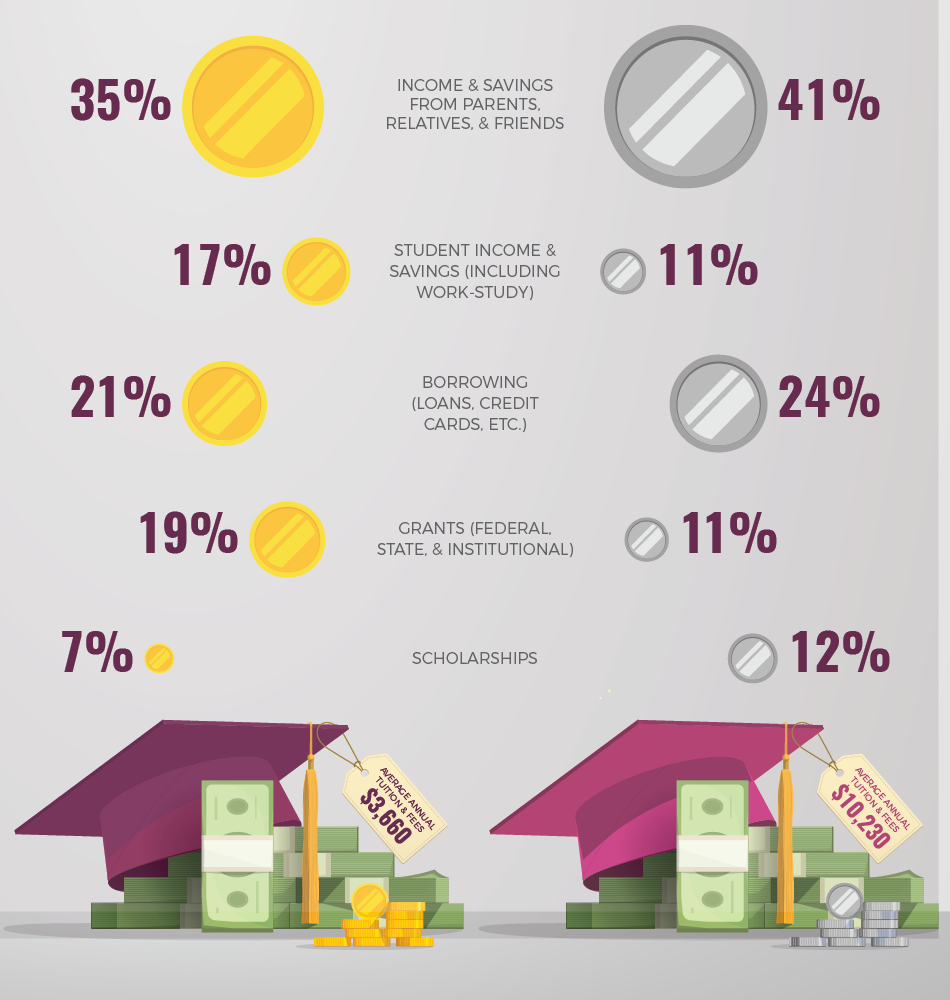

How Students Pay for College

How Students Pay for College

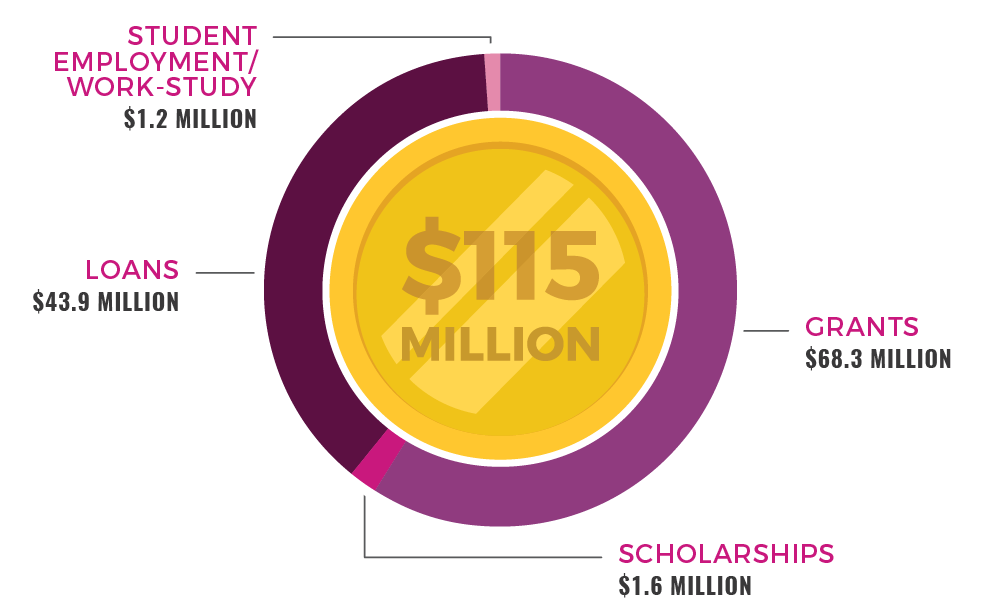

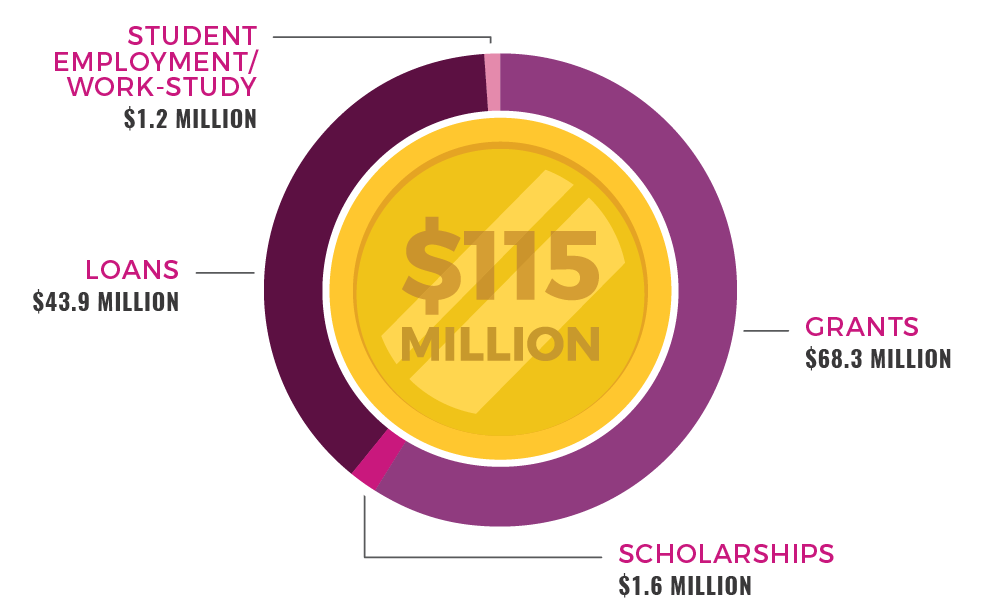

Financial Assistance at NOVA

Top Grants

- Federal Pell Grant

- Virginia Commonwealth Grant

- NOVA Tuition Assistance Grant

Top Scholarships

- Community-Based Scholarships

- NOVA Foundation

- Tribal Funds Scholarship

Top Loans

- Federal Direct Unsubsidized Loan

- Federal Direct Subsidized Loan

The FAFSA Problem

52%

Believed they could afford college without financial aid

49%

Thought they were ineligible or did not qualify for aid

33%

Did not want to take on debt

23%

Did not have enough information about how to complete a FAFSA

14%

Did not know that they could complete a FAFSA

12%

Thought FAFSA forms were too much work or too time-consuming

The FAFSA Problem

52%

Believed they could afford college without financial aid

49%

Thought they were ineligible or did not qualify for aid

33%

Did not want to take on debt

23%

Did not have enough information about how to complete a FAFSA

14%

Did not know that they could complete a FAFSA

12%

Thought FAFSA forms were too much work or too time-consuming

The FAFSA Problem

52%

Believed they could afford college without financial aid

49%

Thought they were ineligible or did not qualify for aid

33%

Did not want to take on debt

23%

Did not have enough information about how to complete a FAFSA

14%

Did not know that they could complete a FAFSA

12%

Thought FAFSA forms were too much work or too time-consuming

Competing Priorities

Employment

A majority of community college students are employed full- or part-time.7 Having a job means less time to focus on studying, but many students rely on this income to pay for basic necessities, such as housing and groceries.

Unexpected Expenses

Unexpected financial challenges can occur at any time and for any student. Since many students lack a financial cushion, an unexpected expense can mean choosing between paying for college or repairing a broken car.

Caring for Children

A large number of community college students are older, which means many are attending college while raising children.8 These students face additional expenses such as childcare and family healthcare.

Competing Priorities

Employment

A majority of community college students are employed full- or part-time.7 Having a job means less time to focus on studying, but many students rely on this income to pay for basic necessities, such as housing and groceries.

Unexpected Expenses

Unexpected financial challenges can occur at any time and for any student. Since many students lack a financial cushion, an unexpected expense can mean choosing between paying for college or repairing a broken car.

Caring for Children

A large number of community college students are older, which means many are attending college while raising children.8 These students face additional expenses such as childcare and family healthcare.

Competing Priorities

Employment

A majority of community college students are employed full- or part-time.7 Having a job means less time to focus on studying, but many students rely on this income to pay for basic necessities, such as housing and groceries.

Unexpected Expenses

Unexpected financial challenges can occur at any time and for any student. Since many students lack a financial cushion, an unexpected expense can mean choosing between paying for college or repairing a broken car.

Caring for Children

A large number of community college students are older, which means many are attending college while raising children.8 These students face additional expenses such as childcare and family healthcare.

Beyond Financial Aid

Beyond Financial Aid

Learn More

Resources for Students, Faculty, and Staff

Students choose to enroll at community colleges in order to pursue a wide variety of personal and academic goals. However, due to the significant investment of time and effort required to attend college, many students will stop out or drop out before they reach their academic goals. Many obstacles can lead students to discontinue their enrollment, including personal, financial, institutional, and academic reasons.

NOVA offers a variety of support services to help students overcome the multitude of challenges they may face that could delay their path toward completion.

Financial Aid Office

Learn more about financial aid and how to apply at: http://www.nvcc.edu/financialaid/index.html

Single Stop

Learn more and find available resources at: https://nvcc.singlestoptechnologies.com

Scholarship Search

Search scholarships for community college students at: https://www.vawizard.org/wizard/scholarShipSearch

NOVA Payment Plan

Learn more about the plan and find the information line at: https://www.nvcc.edu/payment/methods/index.html

Citations

- (2019). Types of Aid. Federal Student Aid, An Office of the U.S. Department of Education.

- Bahr, S., Sparks, D., & Mulvaney Hoyer, K. (2018). Why Didn’t Students Complete a Free Application for Federal Student Aid (FAFSA)? A Detailed Look. National Center for Education Statistics, U.S. Department of Education.

- (2018). Trends in Student Aid 2018. Trends in Higher Education Series, College Board.

- Radwin, D., Conzelmann, J.G., Nunnery, A., Lacy, T.A., Wu, J., Lew, S., Wine, J., & Siegel, P. (2018). 2015-16 National Postsecondary Student Aid Study: Student Financial Aid Estimates for 2015-16. National Center for Education Statistics, U.S. Department of Education.

- (2018). How America Pays for College 2018. Sallie Mae and Ipsos Public Affairs.

- Financial Aid Office, Northern Virginia Community College.

- (2019). Fast Facts 2019. American Association of Community Colleges.

- Noll, E., Reichlin, L., & Gault, B. (2017). College Students with Children: National and Regional Profiles. Institute for Women’s Policy Research.

- (2019). Types of Aid. Federal Student Aid, An Office of the U.S. Department of Education.

- Bahr, S., Sparks, D., & Mulvaney Hoyer, K. (2018). Why Didn’t Students Complete a Free Application for Federal Student Aid (FAFSA)? A Detailed Look. National Center for Education Statistics, U.S. Department of Education.

- (2018). Trends in Student Aid 2018. Trends in Higher Education Series, College Board.

- Radwin, D., Conzelmann, J.G., Nunnery, A., Lacy, T.A., Wu, J., Lew, S., Wine, J., & Siegel, P. (2018). 2015-16 National Postsecondary Student Aid Study: Student Financial Aid Estimates for 2015-16. National Center for Education Statistics, U.S. Department of Education.

- (2018). How America Pays for College 2018. Sallie Mae and Ipsos Public Affairs.

- Financial Aid Office, Northern Virginia Community College.

- (2019). Fast Facts 2019. American Association of Community Colleges.

- Noll, E., Reichlin, L., & Gault, B. (2017). College Students with Children: National and Regional Profiles. Institute for Women’s Policy Research.

Learn More

Resources for Students, Faculty, and Staff

Students choose to enroll at community colleges in order to pursue a wide variety of personal and academic goals. However, due to the significant investment of time and effort required to attend college, many students will stop out or drop out before they reach their academic goals. Many obstacles can lead students to discontinue their enrollment, including personal, financial, institutional, and academic reasons.

NOVA offers a variety of support services to help students overcome the multitude of challenges they may face that could delay their path toward completion.

Financial Aid Office

Learn more about financial aid and how to apply at: http://www.nvcc.edu/financialaid/index.html

Single Stop

Learn more and find available resources at: https://nvcc.singlestoptechnologies.com

Scholarship Search

Search scholarships for community college students at: https://www.vawizard.org/wizard/scholarShipSearch

NOVA Payment Plan

Learn more about the plan and find the information line at: https://www.nvcc.edu/payment/methods/index.html

Citations

- (2019). Types of Aid. Federal Student Aid, An Office of the U.S. Department of Education.

- Bahr, S., Sparks, D., & Mulvaney Hoyer, K. (2018). Why Didn’t Students Complete a Free Application for Federal Student Aid (FAFSA)? A Detailed Look. National Center for Education Statistics, U.S. Department of Education.

- (2018). Trends in Student Aid 2018. Trends in Higher Education Series, College Board.

- Radwin, D., Conzelmann, J.G., Nunnery, A., Lacy, T.A., Wu, J., Lew, S., Wine, J., & Siegel, P. (2018). 2015-16 National Postsecondary Student Aid Study: Student Financial Aid Estimates for 2015-16. National Center for Education Statistics, U.S. Department of Education.

- (2018). How America Pays for College 2018. Sallie Mae and Ipsos Public Affairs.

- Financial Aid Office, Northern Virginia Community College.

- (2019). Fast Facts 2019. American Association of Community Colleges.

- Noll, E., Reichlin, L., & Gault, B. (2017). College Students with Children: National and Regional Profiles. Institute for Women’s Policy Research.